Have You Heard the Term ‘Ship Spares in Transit’? Here’s Why It Matters to You

Ensuring Correct and Effective Importation of Yacht Parts: An Interview with UK Import/Export Consultant Simon Huxley

In the world of international yachting, understanding the nuances of importing yacht parts can save you time, money, hassle and more importantly, keep you on the right side of the law. Balancing the process of buying items and having them shipped to your location smoothly should not be confused with doing so in a tax-effective manner and by the book.

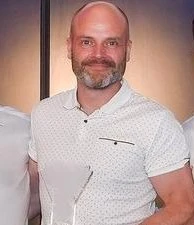

Today, Lumenautica interviews Simon Huxley (SH), franchise owner, InXpress has over 13 years of experience in logistics management, import, export and domestic logistics. He sheds light on the term ‘Ship Spares in Transit’ and its significance for yachts.

Lumenautica: Thanks for your valuable time today, Simon. Your insights will help yacht owners, management teams and crew to understand the niche market of ‘Ship Spares in Transit’ or sometimes called, ‘Ship in Transit’ status and how to use it when receiving goods from other countries regardless of whether the yacht is inside or outside of the EU or anywhere around the world.

So, let’s start with the basics: What do ‘Ship Spares in Transit’ and ‘Ship in Transit’ mean?

SH: Good to be here and thanks for the opportunity to clarify what seems like a simple concept but is actually quite nuanced.

‘Ship Spares in Transit’ and ‘Stores in Transit’ refer to goods intended to be loaded onto or used on a yacht while it’s outside a customs territory where the goods were imported or stored. These items include essential parts and equipment necessary for the vessel’s operation, maintenance, or consumption while in international waters. For example, if someone buys a boat sign from Lumenautica, it could be labelled as ‘Spares in Transit’ or ‘Ship Spares in Transit’. This is perhaps when using a local shipping agent can pay dividends to not only navigate the import laws successfully but also to help you get the shipment processed quickly through your freight forwarding company. As not all countries have the same import and tax systems or even tax rates are the same, a shipping agent will know their local import laws and procedures and can provide you with the best advice.

Lumenautica: Who can use these terms?

SH: Any company or individual, yacht owner, yacht management company or crew member can apply to use the ‘Ship Spares in Transit’ procedure, provided they can demonstrate a legitimate need to buy the item or items. This process ensures that the goods are properly accounted for and managed according to regulatory standards.

Now might be a good time to mention that one of the primary deciding factors on whether the owner of a docked vessel will be subjected to import charges, is the ‘status of the vessel’ in the dock. Put simply, if a US vessel is docked at a port in France and is registered with the French authorities as an international or foreign vessel, then the consignee/vessel may well qualify for VAT and duty exemption. If however, a French registered vessel is docked in a French port and receives spares or a yacht sign, then it’s likely that French customs will apply charges.

Lumenautica: When can they use it?

SH: The ‘Ship Spares in Transit’ procedure can be used for any goods that meet the criteria outlined by customs authorities. Let’s use the example again of buying a yacht sign from Lumenautica in the UK and wanting it shipped to the South of France or Fort Lauderdale. This is particularly useful for yachts making brief stops in multiple ports for short periods of time and needing to replenish supplies or receive new parts without incurring unnecessary or incorrect import taxes and duties.

Lumenautica: What items can they use it for (and not)?

SH: Great question. Basically, all items categorised as ship spares or stores can be included under this procedure. ‘Ship spares’ are specifically for the functionality and maintenance of the vessel, while ‘ship stores’ refer to goods used, consumed, or sold onboard, such as food, beverages, and other consumables. Non-essential personal items or luxury goods not directly related to the vessel’s operation typically do not qualify. Your purchase from Lumenautica would, in principle, come under the need for the functionality and maintenance of the yacht. Both groups can fall under the ‘in transit’ status, but their usage and categorisation differ slightly.

Different criteria apply if you need to return an item for repair or if something is under warranty. Again, working with a shipping agent can provide the best advice, ensuring you remain both cost-effective and tax-compliant.

Lumenautica: Won’t DHL, FedEx or any large fast freight forwarding supplier, just sort this out for me automatically?

SH: Not necessarily. It’s important that the vessel owner or operator provides explicit instructions to the carrier regarding customs formalities. Clear communication with your shipping agent or fast freight forwarding supplier ensures that the ‘in transit’ status is correctly applied preventing potential delays or extra charges. Organisations like World Wide Ship Agencies Association, Multiport or ourselves, can provide you with support.

It might be worth noting that if a customs authority team believes you’ve incorrectly brought the item into their country by accident or fraudulently, not only could you be fined £2,000 per infringement, but the item can be held up, and even destroyed.

While Lumenautica provides you with the commodity codes and item descriptions, commercial invoices and waybill, remember that you have an active role to play.

Lumenautica: What paperwork do they need to produce/share and with whom?

SH: You or your customs agents must ensure that all commercial documentation, such as invoices and bills of lading, is presented to the relevant customs authorities, especially when cross-border movements are involved. Accurate and thorough documentation is critical to avoid delays and ensure smooth processing. Sometimes it’s well worth working with a recognised in-country customs agent who can help you every step of the way, processing your shipment correctly and in the most cost-effective way. While Lumenautica will provide you with the commodity codes and descriptions of the items you’ve bought plus the commercial invoices and waybill, it’s important to remember that you have an active role to play too.

Lumenautica: Are shipping regulations and customs duties ever constant?

SH: No way! You’d be surprised by how frequently things change. New guidelines, updated tax rates, and even whole new laws are introduced regularly. It’s important to stay informed and not rely on outdated information or assumptions to avoid any surprises at customs.

“The most common mistakes include failing to declare goods correctly, by not using the right commodity code and not maintaining accurate records”

Lumenautica: Good to know that. Finally, in your experience, what are the biggest mistakes a yacht makes when it comes to importing items?

SH: Mmmm, I would have to say, the most common mistakes include failing to declare goods correctly, by not using the right commodity code; not providing clear instructions to carriers, and not maintaining accurate records. Another frequent issue is neglecting to consult with a local shipping agent, which can lead to misunderstandings of local regulations and potential fines or delays.

Lumenautica: Thank you Simon for your insight into what most people wouldn’t have given much thought to but could in fact save them money and more importantly, time and stress.

Conclusion

While every case is unique and this is a guideline only and should not be taken as binding, understanding and correctly using the terms ‘Ship in Transit’ and ‘Yacht in Transit’ can significantly streamline your operations and reduce costs. Lumenautica recommends consulting with a local shipping agent or similar to ensure compliance with all relevant regulations.

To contact Lumenautica Yacht Signs get in touch here.

Reach out to Simon at InXpress for support about your import/export needs | Tel: +44 (0)116 4422528 | Mobile: +44 (0)7539005858| [email protected]

Comments are closed.